I have been blessed to mentor some students on how to trade the markets. I am no expert. Just that along the path of trading the markets, I have come to learn a few things the hard way. Out of curiosity I have done research on many aspects concerning the markets. I have spent lots of time trying out so many indicators and trading robots. When I look back, I am grateful that I did learn the hard way. However, I would never want anyone to travel that road. That is why I always share my experience with my students so that they may learn from it; my aim is for them to learn from my mistakes – other than having to travel the entire path themselves and learning from their own mistakes. My desire is to ensure that their trading journey is shorter than mine.

So today I want to share what I refer to as over –trading. What causes it and how to avoid it. Like any other vice or habit, you cannot fight it unless you identify it. The good news is that once you identify it, you will be able to stop it. (And yes, I was once a victim of this terrible habit)

What is over trading?

Over trading is going long or short without following a trading plan. It is trading without pre-defined trading edge. Over trading is belief that the more trades you take, the more chances you will be profitable. This is utter gambling in the markets. If that was the case, all traders would enter thousands of trades at a time and wait for sheer luck to make them profitable. The reason why a trading plan is important is because it allows you to define an edge. The trading journal allows you to monitor yourself and see if you are indeed following the trading plan. Definitely if you have no trading plan, you most likely have no trading journal.

Many times we traders want action. We believe action is what matters to traders. Once we see action, we take trades immediately, afraid the action will cease before we take the trades. In so doing, we take trades without following our pre-defined rules. We take trades without following our trading plans. We take trades without even proper analysis of what could have caused the action. And this too is over trading.

If you have been doing any of the above, it is time to stop. I suggest that you start by identifying an edge and try to follow it. Document all the trades you take in a trading journal and stick to it. It is the only way to know if your trading edge is profitable or not. It took me time to document my trades. The reason was because I used to take so many trades in a day. Now I have at most 3 trades in a day so it is very easy to document each and every trade.

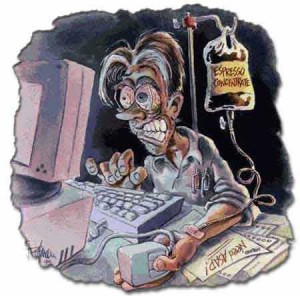

Over trading only serves to make the markets over bought or oversold hence providing edges and entry points for those on the other side of the trade to take very large profitable trades. The good news is that over trading has always existed since the beginning of the markets and as such it will always be there. So you can still change sides and be part of the team on the other side that waits for the edge and take large profits. So many amateur traders believe in over trading – coupled with Robots and all sorts of indicators to help them trade both day and night. Not forgetting that they will subscribe to numerous newsletters, email alerts, news alerts, signal providers and pod casts to know what the analysts are saying. I can tell you over trading has never been a simple task.!!

Now that we know what over trading is and how to avoid it (by discovering an edge and trading it with an id of a trading journal) we need to be profitable traders starting this April 2012 by discovering an edge, writing a trading plan and documenting all our trades in a trading journal.

1 comment:

If I am trading on my maxima and minima, or overtrading on stable trends, its a very viable technique!

Post a Comment